irs child tax credit payment dates

How do I unenroll from the CTC. You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data.

About The 2021 Expanded Child Tax Credit Payment Program

Be under age 18 at the end of the year Be your son daughter stepchild eligible foster child.

. The amount of credit you receive is based on your income and the number of qualifying children you are claiming. The remaining 2021 child tax credit payments will. You can also search for information about an organizations tax-exempt status and.

You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return. 15 The payments will be made either by direct deposit or by paper check depending on what. The American Rescue Plan Act of 2021 increased the amount of the CTC for the 2021 tax year only for most taxpayers.

The credit amounts will increase for many. The IRS says the monthly payments will be. Individuals Child Tax Credit Tax Year 2021Filing Season 2022 Child Tax Credit Frequently Asked Questions Topic A.

The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only. Because of the COVID-19 pandemic the CTC was. Under the American Rescue Plan most eligible families received payments dated July 15 August 13 and September 15.

As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous. It provides information about the Child Tax Credit and the monthly. These changes apply to tax year 2021 only The.

Besides the July 15 and August. The IRS will send out the next round of child tax credit payments on October. Reaction on the Hill.

MILLIONS of Americans have already filed their 2021 federal income tax return by the April 18 deadline. To be a qualifying child for the 2021 tax year your dependent generally must. The Child Tax Credit Update Portal is no longer available.

For these families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. The IRS said. The IRS has created a special Advance Child Tax Credit 2021 page with the most up-to-date information about the credit and the advance payments.

Here are the official dates. 2021 Child Tax Credit Basics These FAQs were. IRS Statements and Announcements IR-2021-153 July 15 2021 WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of.

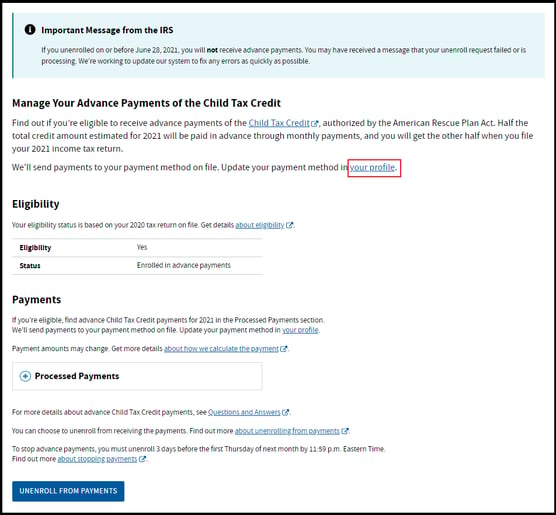

Understand that the credit does not affect their federal benefits. To do that go to the Child Tax Credit Update Portal to unenroll from the monthly payments. Find out if they are eligible to receive the Child Tax Credit.

Families will receive it as a lump sum when they file their 2021 tax return. For 2021 the credit amount is. Fully unenrolling will not stop the Child Tax Credit.

Within those returns are families who qualified for child tax credits CTC. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000. You can use your username and password for the Child Tax Credit Update Portal to sign in to your online account.

Future payments are scheduled for November 15 and. Some of that money will come in the form of advance payments via either direct deposit or paper check of up to 300 per month per qualifying child on July 15 August 13.

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Irs Deadline Nears To Make Final Changes To Last Child Tax Credit Payment Of The Year Weareiowa Com

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Advance Child Tax Credit Payments Youtube

Irs Opens Child Tax Credit Portal How To Check If You Re Getting 300 Monthly Payments Syracuse Com

Tax Tip Irs Provides Answers To Custody Situations That Affect Advance Child Tax Credit Payments Tas

New Child Tax Credit Monthly Advance Payments

Tax Tip Caution Married Filing Joint Taxpayers Need To Combine Advance Child Tax Credit Payment Totals From Irs Letters When Filing Tas

Irs Sent Over 1 Billion In Payments To Ineligible Families Audit

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

New Irs Letters For Recipients Of The Child Tax Credit Advance And Third Stimulus Payments Alloy Silverstein

Tax Tip Irs Statement On September Advance Child Tax Credit Payments

/cloudfront-us-east-1.images.arcpublishing.com/gray/4WFOZIVSSRDMLDJEBJZAF3BNF4.jpg)

Stimulus Update Child Tax Credit Payments To Start Hitting Bank Accounts Thursday

Irs Releases Child Tax Credit Payment Dates Here S When Families Can Expect Relief

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

2021 Advanced Child Tax Credit What It Means For Your Family

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News